Do you want to make the best-informed financial decision all of the time? Duh. Of course you do. You’re not a dummy. Well, what if I told you there was a way to always make the correct financial decision? It probably sounds like some scam, but it isn’t. It’s the power of compounding that Albert Einstein supposedly referred to as “the eighth wonder of the world.”

The thing to remember about humans is that we are emotional creatures. Sure, our bodies are complex wonders and our brains can be, too. But we feel comfortable when given the simplest solution to problems. We’re not the greatest with complicated formulas and we don’t like to use calculators if we don’t have to. We want to see and hear facts in their simplest forms. We are linear thinkers. For example, if we’re taking a trip from New York to Wisconsin, we tend to think in terms of straight lines; we don’t consider all the twists and turns (complexities) between here and there. Getting there, like life, is a bit more complicated.

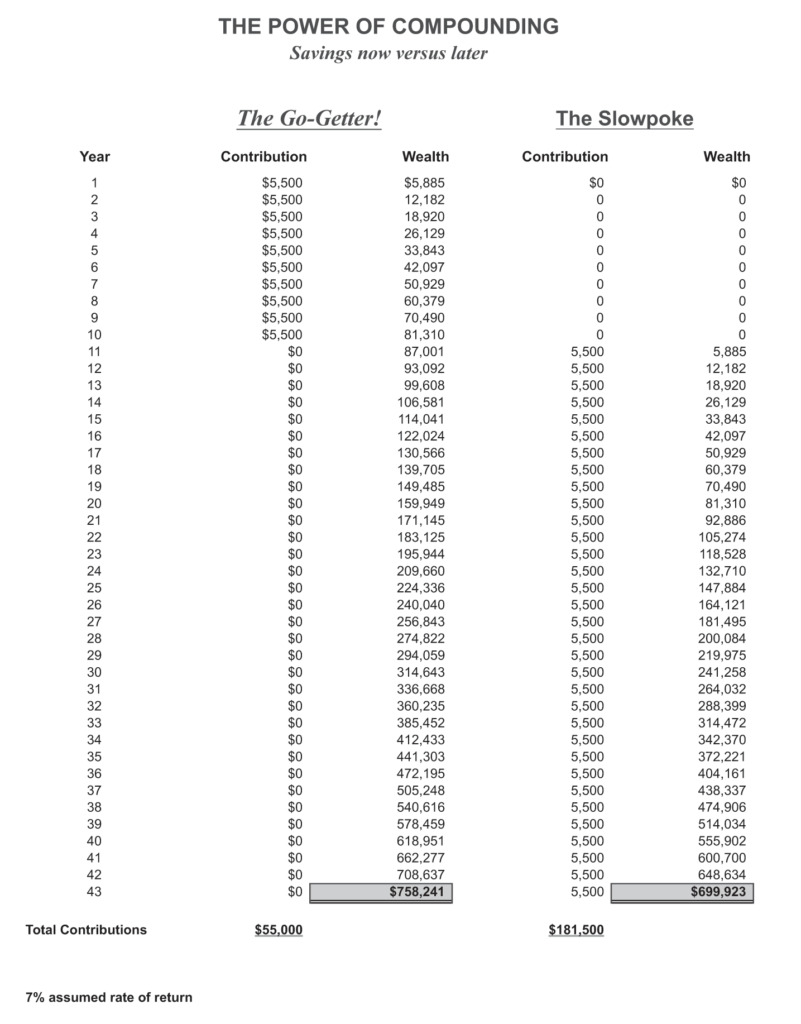

Compounding always rewards the person who saves sooner.

You’re probably thinking, great, we’re emotional and want simple solutions, but what does that have to do with my money? Well, money doesn’t grow in a linear fashion either; it can compound in a geometric way.

Banks in the nineteenth century used simple interest calculations, but they soon realized that compounding was a far better way to make money. I compare it to bacteria in a petri dish. A bacterial colony starts out slowly; one cell becomes two, which become four, and so on. But at a certain point the doubling really takes off, and you’re talking about much larger numbers being created in the same span of time. It’s the same with your money.

Let’s take two people as an example: “The Go-Getter” and “The Slowpoke” both have an extra $5,500 coming in annually. Go-Getter puts it away and, after 10 years, stops saving and just lets it grow and compound. Meanwhile, Slowpoke finds ways to spend the extra cash now, letting it slip through his fingers. He goes along like that for 10 years, then starts saving in the 11th year.

By year forty-three, Save Sooner, who put away $55,000 in the first 10 years then didn’t save anymore, has more money ($758,241) than Save Later, who waited until year 11 then saved for 33 years ($699,923). In fact, the slow saver had to save three times more than the early saver and was still behind in the end.

It’s a no-brainer. Use the wonder and power of compounding to benefit you. Don’t be a slowpoke: Get out of the gate quickly. Now that you know about compounding….you’re smarter than that!

Access my FREE online mini-course (8 videos + worksheets) today. Learn the importance of having a leadership mindset and a championship team to fuel your success. Take the first step towards mastering your cash flow, finances, and life!